At a recent event in Copenhagen, Ford declared that it would be shifting to an agency model across Europe. With an eye on transforming its sales strategy for an era of electrification, the US auto giant said that it planned on adopting an omnichannel focus to deliver seamless, transparent, and personalized “next-generation customer experiences”.

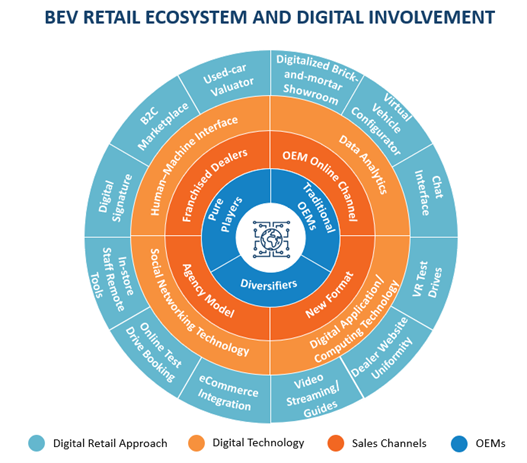

Over the next decade, electric vehicle (EV) sales will rise sharply even as market participants turn to innovative digital retail strategies across the value chain. Digitalization in new battery EV (BEV) retailing is set to reshape OEM approaches to customer engagement, retail activities, and online sales strategies. While a host of sales channels – franchised dealerships, OEM online channels, agency sales model, and new formats which includes flagship experiences and pop-up stores – will be in play, it will be the agency sales and new format models that will lead the way.

Margin pressures related to traditional sales and distribution networks will be among the main catalysts triggering a shift to online retail models for electric vehicle sales. Here, online models will support substantial savings on personnel, inventory, and logistics. The push towards a seamless digital retail journey will also receive impetus from Gen Zs and Millennial customers – an increasingly prominent segment of automotive buyers. More generally, greater customer familiarity with and preference for the convenience of online purchases, particularly post-COVID, will provide a fillip to digitalization in automotive retailing.

At the same time, regional regulations, some of which prohibit direct online sales, will slow down the digitalization makeover. For example, some US states mandate the involvement of a local dealership in the sales process. The pace of adoption will also be constrained by the need to build the new skills and infrastructure required to implement novel business models centered on retail digitalization.

To learn more, please access our research report Growth Opportunities from Digital Retail Initiatives for New Electric Vehicles in Europe, North America, and China, or contact [email protected] for information on a private briefing.

Current Trends

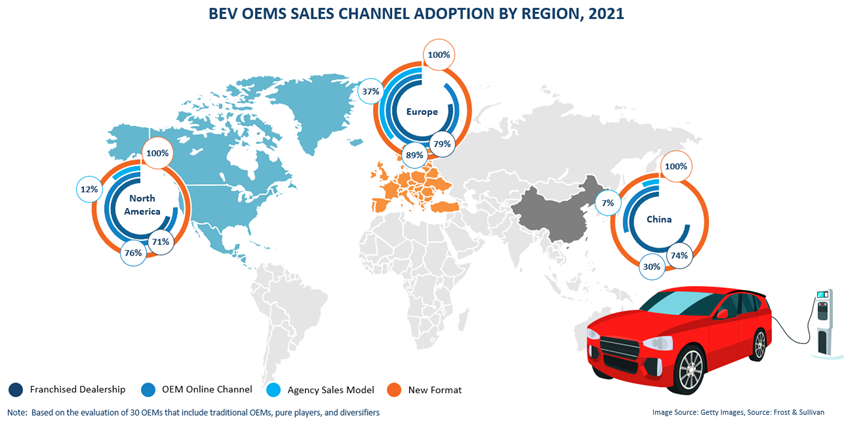

Today, pure players unburdened by legacy structures have been first off the mark even as traditional OEMs’ entry into the online direct-to-consumer (D2C) domain has been slowed by legacy structures in their sales set up. Existing contracts and the reluctance of dealerships to shift to D2C models have hobbled traditional OEMs who sell primarily through dealerships. Little surprise then that in 2021, franchised dealerships accounted for a significant 28.9%, 31.1%, and 34.1% of electric vehicle sales channel shares in Europe, North America, and China, respectively. However, what is becoming amply clear is that a digital D2C sales model will be crucial for OEMs to access customer data and leverage the information to create more targeted retail business strategies.

In terms of digital retailing technology, live streaming has been experiencing the widest adoption led by Chinese OEMs. NIO, for instance, bagged almost $18 million in orders through a 40-minute live stream session in 2020. Other popular technologies include virtual vehicle configurators and virtual reality test drives.

Digitalization of sales channels has resulted in varied approaches to route-to-market. While traditional OEMs have been partnering with B2C online marketplaces, pure players are focused on selling through their online channels and flagship stores. In 2021, OEM online channels across all markets racked up one million BEV sales, with China spearheading the wave with 0.5 million in online BEV sales.

Two Digital Models Gaining Popularity

Agency sales and new formats are emerging as the most popular digital new BEV retail channels. Agency sales will center on the integration of the online and offline selling process. Here, OEMs deal directly with customer sales contracts, and dealers act as agents on a commission basis to sell the vehicle.

New formats in the retail sales process focus on unique flagship experience, pop-up stores, and business-to-customer (B2C) marketplaces, such as vehicle-buying portals/third-party aggregator sites.

Tesla’s experience showrooms/galleries have been a trendsetter in terms of streamlining the customer experience from taking test drives, configuring vehicles, making bookings, and receiving vehicle delivery. Rivian and Lucid Motors in North America and XPeng’s showrooms offer similar experiences.

B2C marketplaces are another new format to which many traditional OEMs are turning because of their flexibility and cost-effectiveness. Here, the OEMs pay a fixed commission to third-party B2C marketplaces when customers purchase from their portal. Nevertheless, Chinese pure player OEMs widely use B2C marketplaces.

Future Outlook

Digitalization will trigger dramatic change across the entire automotive ecosystem. From the perspective of customer demand, the rising importance of a younger cohort of buyers will mean the need to ramp up the use of social media platforms in retailing. In addition, their preference for a seamless purchase experience will drive investments in digital sales. In future, customers can look forward to not only choosing but also customizing vehicles on social media applications.

Tesla operates its own online and flagship stores, underlining the first mover advantage that pure players have enjoyed in being able to rapidly build D2C digital retail models without being hampered by legacy dealer networks. This will pressure traditional OEMs to step up the pace on their own digital, D2C transformation. They will engineer a two-pronged strategy: one, using the agency sales model to gain direct customer access and, two, revising dealers’ agreements to establish a competitive BEV sales strategy. This shift will reduce the volume of franchised dealership generated sales; our research indicates that by 2028, dealers will account for only 14.2%, 18.1%, and 24.1% of BEV sales channel shares in Europe, North America, and China, respectively.

As technology advances and the adoption of 5G increases, we expect more OEMs to embrace live streaming in the US and Europe. What will be particularly exciting will be boundary-pushing initiatives anchored in a metaverse-enabled experience, using AR and VR in the digitalization of EV marketing and sales.

We will see traditional OEMs investing in their own online channels in a bid to develop their D2C sales networks. Simultaneously, pure players will strengthen their D2C channels, passing on the cost savings accrued from direct online sales to customers in the form of more competitive vehicle pricing. Our research highlights that OEM online channels will generate sales of about 4.7 million BEVs by 2028. China will account for around 2 million of these sales, followed by Europe at 1.7 million.

Digital retailing of new BEVs will underpin a 360° pivot in OEMs’ business focus. Here, direct access to customer data will result in automakers transforming from product-centric, hardware-focused vehicle manufacturers to becoming customer-centric, digitally driven mobility providers.

Conclusion

Retail value chain stakeholders explore omnichannel sales model to enhance customer buying options. Digitization across the entire sales process to result in online purchase convenience with better buying experience to customers and, create new revenue opportunities for retailers.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility