Frost & Sullivan analyzes the business impact of COVID-19 on India

Like other economies, India has been rendered vulnerable by the COVID-19 crisis. Wholesale and retail trade, transportation and storage, ICT, food and nutrition, and the financial and insurance sectors have all been affected.

However, it’s not that everyone and everything is capsizing. Some sectors in India have made gains and exciting opportunities are emerging, while careful risk mitigation strategies are helping others chart a new course for the future.

A Changed Economic Environment

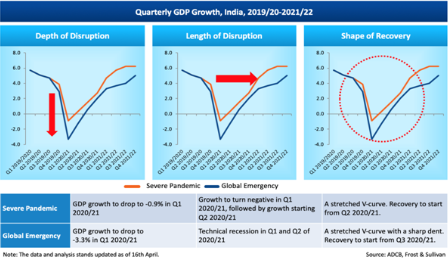

Exhibit 1: What could the depth, length, and shape of recovery look like?

Based on dynamic, real-time updates, Frost & Sullivan’s research indicates that COVID-19 could play out in two ways. The first scenario of a Severe Pandemic will be marked by downturns in consumer demand, industrial production, and GDP growth. The outbreak will be mostly contained by the end of May, with the economy showing signs of industry and economic rebound by Q2 FY’20-21and showing full recovery by Q1 FY’21-22

If the pandemic is not contained to a large extent by the end of May, the second scenario of Global Emergency would ensue, marked by the uncontrolled spread of the pandemic with economies limping back to recovery from Q3 FY’20-21, with a full recovery only after Q4 FY’21-22.

Impact and Implications for Eight Key Sectors in India

Notwithstanding pockets of growth in network implementation and management services, the ICT sector is likely to decline as a whole. The pandemic will, however, catalyze unprecedented growth in digital services and technologies that enable digitalization. While most hardware segments will shrink, rising demand for workforce management, collaboration, security, remote access, and productivity tools will energize the enterprise software segment. Big Data, the digitalization of government services and healthcare services, and wider 5G use cases across industries will characterize the ICT sector in a post-COVID-19 period.

Travel restrictions and country-wide lockdowns have pummeled the food & nutrition sector. The total food market compound annual growth rate (CAGR) is expected to drop from 7.2% to 6.8%, with annual forecasted revenues dropping from $75 billion to $58 billion in 2020. Meanwhile, quick-service restaurants (QSRs) and fast-food eateries have realigned operations to serve only delivery and takeaway orders. Food and nutrition retail is in flux with disrupted supply chains, consumers bulk-buying long-shelf-life food and nutrition products, and hoarding/panic buying throwing traditional demand projections into disarray. The nascent e-commerce industry has received a fillip with new growth opportunities for primary packaging materials manufacture. Increased demand for immunity supplements is also expected.

The healthcare sector is expected to experience a short-term decline in revenues across all major sectors in 2020. This will be a result of reduced consumption caused by delays in elective surgery and lower purchases of medicines due to fewer prescriptions. During the pandemic, emergency visits are expected to drop 58%, outpatient and ambulatory care to drop 81%, in-patient admissions to drop 80%, and dental and cosmetics to drop 95%. Shortages in medical devices like ventilators and test kits and operational issues, including the disruption of clinical trials and inadequate virtual care, will further exacerbate challenges. On the positive side, COVID-19 is poised to trigger double-digit growth in telemedicine and virtual care solutions, highlight the need for higher local production of essential drugs, and underpin the growing importance of online pharmacies.

Ongoing uncertainties will have a sharp impact on the mobility sector. Consumer traffic in physical showrooms is expected to dip with an up to 20% drop in new vehicle sales in 2020. Shared mobility has taken the largest hit, with a 50-55% drop in business. Demand for vehicle servicing and parts, short-term car rentals, and shared mobility services will wane steeply. Exasperating the situation is an already weakened consumer demand due to a drop in private investment and a banking crisis, making it difficult to access credit. Overall vehicle sales are expected to continue dropping in 2021, with the automotive industry expected to recover by 2022. The recent backlash against Chinese manufacturing could present an opportunity for India, especially as an alternative supply chain market for electronics manufacturing and auto components.

Countries that have been hit hard by COVID-19 contributed nearly 50% of global trade in 2019, including 1.7% from India, which will impact its transport and logistics sector. Global trade is expected to decline by 15%, with the top 20 exporting economies currently under stress. More immediately, the sector will face challenges in the form of supply chain disruption, capacity constraints, and cost pressures. However, the crisis will motivate the building of shock-resilient supply chains in food and healthcare logistics while creating a greater impetus for supply chain digitization. Warehousing will gain greater operational efficiencies through the use of robotics, artificial intelligence, and augmented reality tools.

The industrial sector will embrace new paradigms—digitalized, decentralized, decarbonized, circular, and curative—in the aftermath of COVID-19. Currently, disruptions in material supply and logistics and labor mobility are having a significant impact on the construction segment. Oil and gas revenue will drop by 9% with a recovery time of around 9 months due to the twin shock of a global glut in oil supply and a domestic slump in demand. Water revenue will drop by 25.5% with a recovery time of around 6 to 12 months, with industrial and building segments being most impacted. Electronics will also have a large revenue drop of 30% with a recovery time of nine months. The impact on the power subsector will be relatively less severe with a revenue drop of 4.85% and recovery time is expected to be around 4 months due to its essential nature and long gestation associated with new capital investments. As the sector regroups, there will be newer and wider applications for automation and digitalization technologies. Additionally, autonomous operations in manufacturing, in-house manufacturing capabilities, supply-demand assessment, site inspection, and predictive maintenance will pick up the pace.

The chemical sector is expected to have a short but sharp impact in 2020. Demand for petrochemicals, including plastics, synthetic rubbers, and synthetic fibers, will be impacted, making feedstock production from Naphtha cracking profitable. The export of key drugs is banned by the government to ensure domestic availability. Identifying structural solutions that will aid the manufacturing of critical inputs in the country will be prioritized. Due to a surge in demand for immunity supplements, pharmaceutical and healthcare companies are expected to heavily spend on promoting dietary supplements. The chemical sector has been highly dependent on Chinese imports, so this is an opportunity for domestic capacity scale-up, developing alternative sources of supply and investment in backward integration.

Weak domestic demand for the metals sector is expected during 2020, with slow growth over 2021. This is primarily due to the likely slow revival of construction, infrastructure, and automotive sectors, which are facing raw material and component shortages along with a labor shortage. Due to construction halts, the demand for aluminum extrusion is expected to decline. This situation creates an opportunity to focus on utilizing hot metal for VAP (value-added products) and recycled aluminum scrap to make run-of-the-mill products, ensuring reduced dependency on bauxite/alumina. Mitigate risks by hedging the London Metal Exchange (LME) price index, since the LME cash Q1 volatility applies to both smelter and downstream industries.

Look Ahead, Anticipate and Adjust

The duration and severity of COVID-19’s impact on economies and sectors will undoubtedly vary. However, companies should set in motion a “look ahead, anticipate and adjust” roadmap. Over the near term, companies should explore supply-chain diversification and leverage new opportunities arising from changing customer demands. Over the long term, product and service portfolio diversification will be critical to ensuring greater resilience.

Externally, strengthening brand equity, and shifting sales channels online will be strategically important. Internally, adopting technologies that support workplace and operational continuity will enable companies to hit the ground running, following the COVID-19 crisis.

Work Done by Frost & Sullivan on COVID-19:

To know more about Frost & Sullivan’s analysis on COVID-19 from across the globe, visit – https://staging.frost.com/insights/covid19/.

Should you have any queries on the impact of COVID-19 across industries, need more information or would like to schedule an interview/interaction with our spokesperson, please email Priya George at [email protected].