Focus to be on flexible, dedicated electrified ‘skateboard’ platforms with inherent automation capabilities

Vehicle design and development are transforming in tandem with the automotive industry’s shift towards electrification and autonomous driving. Recognizing the limitations of conventional chassis platforms that are oriented to vehicles with internal combustion engines (ICEs), automotive manufacturers are looking at dedicated ‘skateboard’ electric vehicle (EV) platforms that offer the promise of superior cost efficiencies and enhanced value propositions.

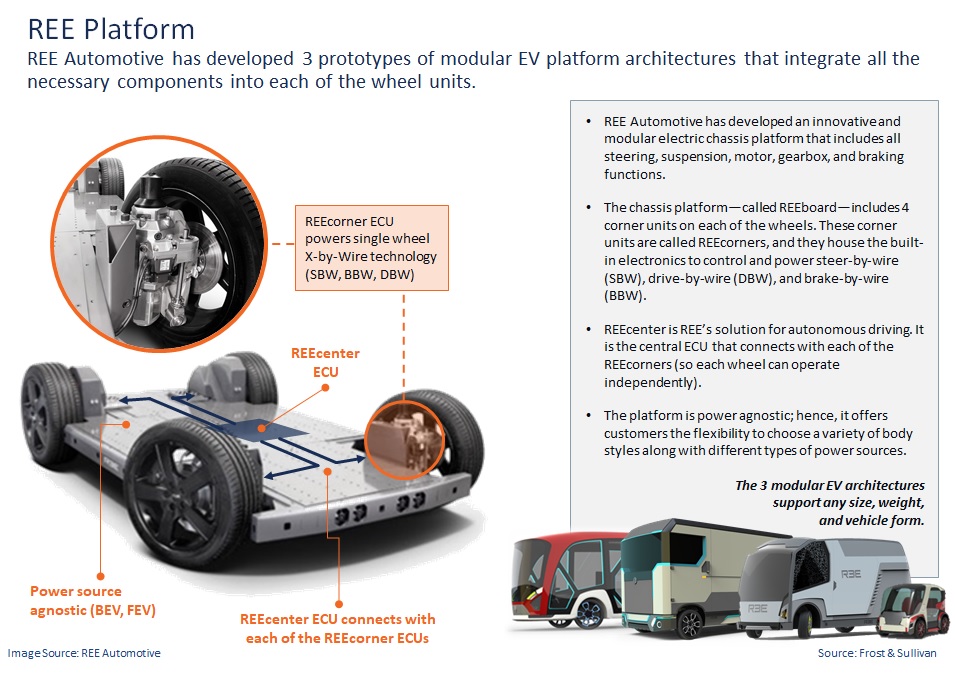

In this context, Frost & Sullivan’s research emphasizes the importance of building modular, scalable, purpose-built EV platforms with inherent automation capabilities that will anchor the transition from ICE to eMobility and successfully address the challenges of connectivity, automation, shared and electric (C.A.S.E.) convergence.

Shortcomings of Conventional Platforms Exposed in an Increasingly Software-driven Industry

Increasingly, vehicles are being defined not so much by hardware and horsepower as by software and computing power. This reflects the rise of connectivity, automation, and electrification trends that tend to be driven more by improvements in software rather than hardware. The need to continuously

Incorporate features demanded by consumers has further aggravated technological, competitive and cost pressures on OEMs and industry stakeholders.

Today, software architecture in vehicles comprises five or more domains, each of which involves multiple functional components, including, for instance, chassis, infotainment, connectivity, powertrain, body, security, and operating systems. While OEMs are able to develop some of these internally, others will need to be bought from suppliers. We see this fragmented approach as intensifying challenges related to control interfaces and integration.

An interesting point to note here is the comparison between disruptors and legacy OEMs. Disruptors like Tesla and Waymo have proven competencies in developing software in-house. In contrast, traditional OEMs like VW and Daimler currently follow the piecemeal approach and are dependent on suppliers. Legacy players have the manufacturing capability and are investing heavily in building better cars. We’ve got our compass fixed on Mercedes-Benz EQS which is touted to be better than Tesla Model S. In short, legacy OEMs are catching up fast with their newer counterparts.

In tracking OEMs’ transition from well-established, ICE-focused chassis platforms to electrification, we have identified the emergence of three distinct platforms – conventional platforms, multi-energy platforms (MEPs), and EV platforms.

Having been designed for ICE vehicles, conventional chassis platforms lack the flexibility to accommodate any major changes to vehicles. Therefore, adapting them to manufacture battery electric vehicles (BEVs) will be both time-consuming and resource inefficient. Significant investments and design modifications will be required to accommodate electrification or new functionalities like automation and connectivity.

Modular MEPs have been designed to support the development of multiple body styles and powertrains like ICEs, hybrids and EVs. While their structure is not skateboard style, they are more flexible than their conventional counterparts. Accordingly, we believe they represent a short-term solution in the move towards electrification.

Dedicated Electrified Skateboard Platforms in the Spotlight

The obvious challenges with scaling conventional platforms mean that OEMs will need to assess dedicated electrified skateboard platform strategies. So what do we see as being the advantages of this approach? At the most fundamental level, we think it provides the necessary power electronic components and flexibility to meet diverse performance needs and integrate different body styles.

Improved cost, time, and resource efficiencies further highlight the advantages of purpose-built EV platforms. In terms of cost, although considerable initial CAPEX is required to develop dedicated, scalable EV platforms, the flexibility they offer and the higher average unit production per platform will drive economies of scale, thereby offsetting the high initial expenditure.

In addition, EV platforms promote tremendous time savings in terms of having the capability to manufacture a range of different BEVs. Assembly also tends to be faster and simpler, again supporting superior resource efficiencies.

New Business Models are Reshaping Competitive Dynamics

Interestingly, developing vehicle platforms is no longer the sole preserve of OEMs. Instead, OEMs / developers are licensing skateboard platforms from start-ups, much like Ford developing its EVs on Rivian’s skateboard platform.

Simultaneously, non-traditional automakers like Waymo, for example, are partnering with either OEMs or with Tier I companies to source vehicles or acquire suppliers to build chassis technologies. Backed by their competencies in integrating autonomous technology as well as building chassis technologies, Tier I suppliers will play a central role in the move toward electrification.

Amidst this churn, new business models are emerging in platform development. These include co-creation which draws on a partnership approach to accelerate platform development; licensing models which focus on selling the technology, and in-house development models that target full ownership of the platform.

Navigating towards a C.A.S.E Future

The convergence of C.A.S.E. technologies is inevitable. Accordingly, we believe that skateboard platforms for EV production should necessarily incorporate in-built autonomous capabilities. Future EV/AD platforms should be pegged on the fundamental attributes of being not just modular and scalable but, particularly in the context of autonomous vehicle development, also ‘fail operational’.

With EV profitability remaining a key challenge for many OEMs, technology-related improvements, design enhancements, and production economies of scale will be crucial to managing costs and boosting profitability. At the same time, OEMs / suppliers could potentially embrace a collaborative approach for platform licensing to offset the high capital costs associated with platform development.

And finally, our advice to automakers would be to adopt strategies that weld together flexible and innovative software with hardware to yield successful outcomes.

To learn more, please read our recent research: Future Skateboard and Platform Architecture Strategies of Electric Vehicle (EV) Companies