Light Detection and Ranging (LiDAR) system developers have been much in demand as automakers start building the software defined vehicles (SDVs) of the future, with companies like Velodyne, Valeo, Continental, Aurora, Quanergy,Opsys, Luminar, and Innoviz at the forefront of disruptive innovation.

LiDAR sensors are instrumental to increasing the levels of autonomy in self-driving vehicles. With the rise in autonomous driving (AD) and advanced driver assistance systems (ADAS), the deployment of LiDAR sensors in vehicles is on an upward trajectory. This is mirrored in the expanding number of partnerships—Luminar and Mercedes-Benz, Velodyne and Baidu, Valeo and Stellantis, and Cepton and General Motors—that underline the growth prospects for LiDAR technology in tandem with the increase in AD and ADAS features. In consonance with such trends, Israeli LiDAR company Innoviz Technologies recently entered into a partnership to supply its LiDAR sensors as well as its advanced customizable perception software to Volkswagen’s software unit, CARIAD. The company’s ‘Innoviz Two’ will underpin VW’s SDV architecture and its operating system, “VW.OS”, helping the automaker move towards its goal of commercializing SDV EVs by the middle of the decade.

“The innovative Innoviz Two has a range of up to 300 meters and a wide field of view, allowing the LiDAR sensor to complement the sensor suite in providing L2+ and L3 capabilities in the vehicle. Such performance indicators besides, Innoviz has worked to keep costs down on its solid-state sensors with a view to penetrating the mass market segment. Such factors have underpinned Innoviz’s deal to supply millions of LiDAR units to Volkswagen, while raking in an estimated $4 billion.” – Thirumalai Narasimhan, Senior Research Analyst, Chassis, Safety and Autonomous Driving, Mobility Practice, Frost & Sullivan.

To learn more about growth opportunities, market dynamics, and competitive benchmarking in the global LiDAR market , please access our research reports, Global LiDAR R&D Portfolio Assessment and Growth Opportunities, Global LiDAR Growth Opportunities and Frost Radar™: Global Automotive LiDAR, 2021, or contact [email protected] for information on a private briefing.

Even though the LiDAR market is quite nascent, it has realized game-changing advancements such as optical phased array (OPA) and frequency modulated continuous wave (FMCW) that could become the go-to technologies during the second half of the decade. These technologies could trigger disruption by motivating OEMs and Tier Is to shift from traditional micro-electro-mechanical systems (MEMS) technology.

While the winner of the LiDAR race is still undecided, what is certain is that almost all OEMs looking to provide AD features will need to establish partnerships with LiDAR developers in order to gain critical first-mover advantage. With an array of technologies on offer, it is becoming essential for OEMs to identify the LiDAR technology that synergizes with their requirements.

Automakers Look to a Future with SDVs

SDVs allow OEMs to decouple hardware and software, allowing OEMs to standardize hardware, while simultaneously providing them the freedom to implement over-the-air (OTA) updates over the lifetime of the vehicle.

Additionally, it enables OEMs to achieve regulatory compliance with global, regional, and country specific mandates related to ADAS, AD, feature on demand (FoD), and other functions. Furthermore, decoupling software and hardware facilitates the standardization of toolchains making OEM development processes consistent across internal teams and external stakeholders.

The recent news on CARIAD suggests the same. LiDAR from Innoviz, joint development with Bosch for a standardized software platform for all VW vehicles, BlackBerry QNX technology for VW.OS (including its QNX OS for Safety, which is a pre-certified microkernel operating system designed for safety-critical embedded systems), and Qualcomm Technologies’ system-on-chips (SoCs) for the VW software platform underline how automakers are on the fast-track towards an SDV future.

Our Perspective

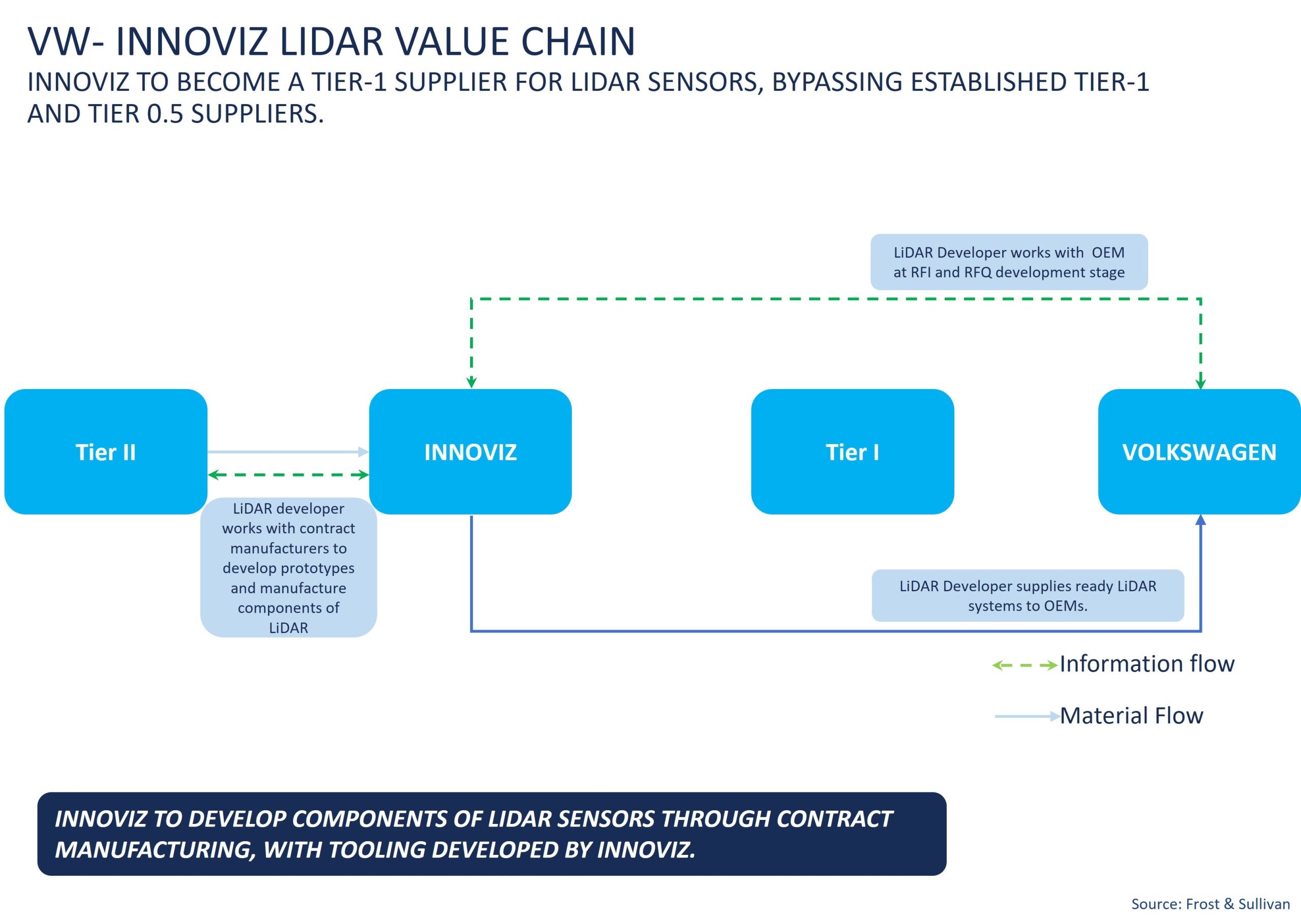

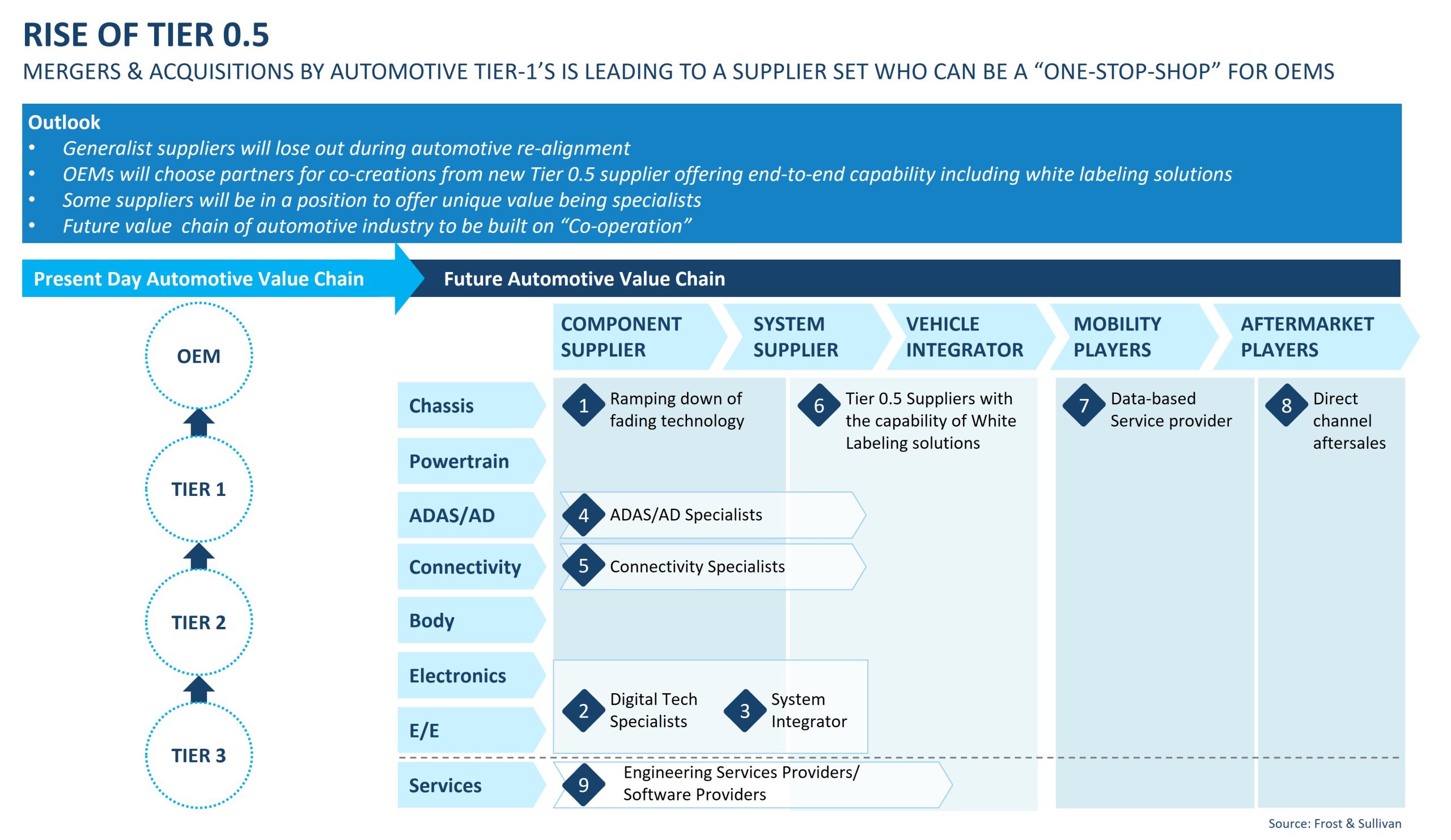

“Because of SDV, we can foresee a trend of further consolidation in the supplier base. Large Tier 1 suppliers in the recent past have strategically acquired companies to expand their offering and potentially move towards a Tier 0.5 space. While Tier 2 and Tier 3 will elevate themselves to Tier 1 status, CARIAD’s deal with Innoviz highlights a Tier 2/3 elevating to Tier 1.” – Manish Menon, Program Manager, Connected Cars & Autonomous Driving, Mobility Practice, Frost & Sullivan.

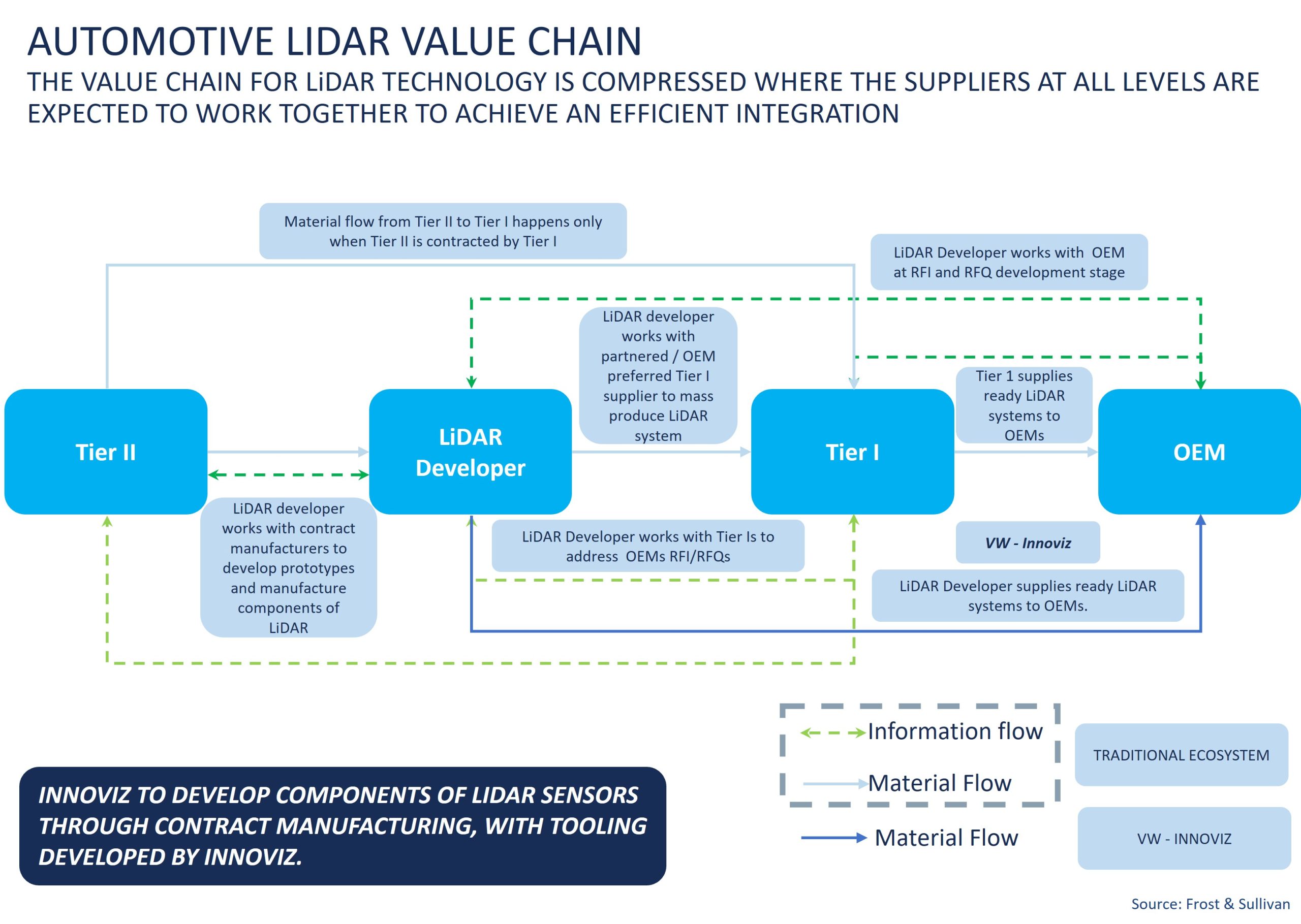

Indeed, new LiDAR developers are coming up with different solutions and changing the dynamics of the LiDAR value chain, leading to its compression and collaborations between Tier I suppliers and OEMs.

“A key highlight of this deal has been the absence of a Tier-1 supplier, marking a distinct shift away from previous trends where LiDAR developers, including Innoviz, supplied to a Tier-1 supplier that already had a well-established relationship with the OEM,” adds Menon. “The integration of the LiDAR system would occur at this point in the value chain before final product delivery to the OEM.”

From this perspective, the Innoviz-VW deal is unique. It will require Innoviz to develop a contract manufacturing ecosystem and supply the LiDAR units directly to Volkswagen, showcasing Innoviz’s tremendous capability enhancements over the past few years.

Today, the nascent LiDAR market has close to 100 players globally. Some Tier I companies are simply following others in investing in LiDAR technology, while others are innovating and spurring OEMs into embracing LiDAR sensors for ADAS and AD.

As LiDAR technology progresses, the focus will be on economies of scale and lower cost sensors. The initial set of companies able to achieve high-performance, low-cost LiDAR solutions will gain first-mover advantage and be optimally positioned to penetrate the mass market.

Schedule your Growth Pipeline Dialog™ with the Frost & Sullivan team to form a strategy and act upon growth opportunities: https://frost.ly/60o.