Introduction: AMI Imperative for Smart Grids for Effective Consumer Participation

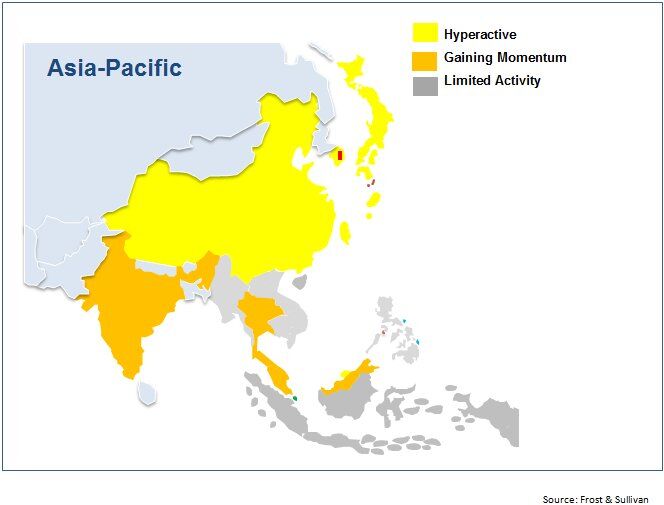

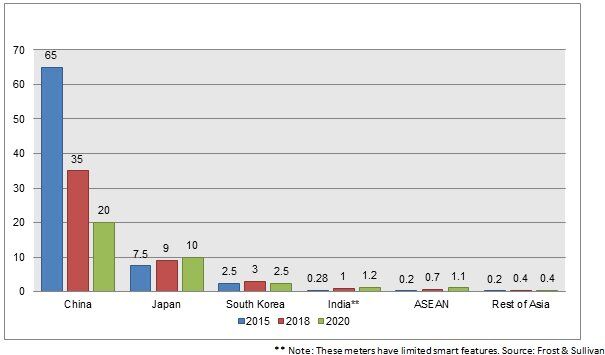

Driven by the Chinese national rollouts, the Asian Advanced Metering Infrastructure (AMI) market grew rapidly in 2014. China’s share was 75% of this market that year. It is expected that globally around 100 million smart meters will be installed annually until 2020.AMI is the basic infrastructure needed to enable effective consumer participation in the power system, as it provides data on electricity price and power consumption to customers. As the number of ‘prosumers’ in the grid increases, AMI becomes an inevitable part of the smart grid plan. Japan and South Korea are the next hotspots with large scale roll outs happening since 2014. In Southeast Asia, Malaysia, Thailand, and The Philippines have notable developments initiated for the next 2-3 years.

AMI Market Heat Map: Asia, 2016

China: The Global Game-Changer Constituting 75% of Market Share

China’s commitment to green development will be the primary driver for smart grid investments and AMI rollouts till 2020. Massive wind and solar power addition to the power grid are being carried out and the total generated power is likely to cross 120 GW by 2020. This addition includes building integrated PV and rooftop PVs. The demand side participation can be realized with the installation of AMI and demand response programs. Besides, Chinese meter costs are some of the lowest in the world, due to the highly competitive nature of the market, relatively low-level technical specifications, and the economies of scale achieved through high order volumes.

The Chinese AMI market reached its peak in 2014, largely driven by the regulatory mandate from the Chinese Government. The grid companies in China, namely State Grid and South Chinese Grid have pooled investments into the smart grid program in the past few years. Frost & Sullivan estimates that the current economic uncertainty in the Chinese economy is unlikely to affect the AMI market. The roll out plan will be largely completed by 2020, following which 10 year old meter replacements will drive the market.

Japan: AMI Roll Out Being Driven by Residential Participation in the Retail Electricity Market

Japan approaches smart grid as the next big opportunity that encourages residential participation in retail electricity market. Tokyo Electric Power Company (TEPCO) in Japan has announced plans to implement AMI as an important constituent of smart grid demonstration projects. Residential smart-meter deployment has been taken up in a high pace in 2016. In 2015, 7.5 million smart meters were installed. As Japanese utilities speed up their rollouts ahead of electricity market liberalization in 2016-2017, residential AMI installation picks up in 2016. Japan is expected to rollout 78 million AMIs by 2024.

South Korea: 29.1 Million AMI to Be Installed By 2020

The Jeju smart grid test bed project ended in 2011, and Korea Electric Power Corporation (KEPCO), the electrical utility, started nation-wide AMI roll outs in later 2011. There are 19.1 million KEPCO consumers and 10.0 million non-KEPCO consumers in the country. Around 80% of AMI installations at these premises will be completed by 2018, and 100% by 2020.

India: Nascent Market with High Growth Potential

AMI market in India is in its nascent stage. Ministry of Power funded 14 smart grid pilot projects under the ‘Smart Grid Task force’, which is being carried out at various states. About 280,000 smart meters were installed in 2015, and this number is forecast to increase to 1.2 million by 2020. However, most of these meters are likely to be of extremely low specification, in many cases only fitted with mobile read communications (the most basic form, where the meter is read by somebody passing by the property). This does not fit the AMI specifications per say.

Smart Electricity Meter Market: Annual Unit Shipment Forecast, Asia- Pacific, 2015, 2018, and 2020

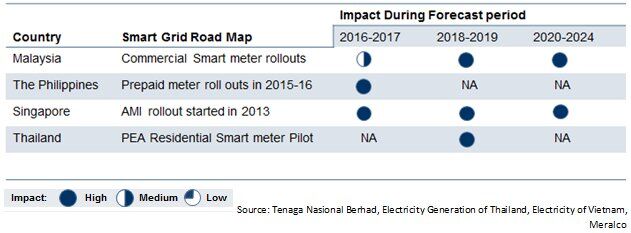

ASEAN: Slow Growth Forecast till 2017

The utilities in the region have not been aggressive in adopting smart grid initiatives. However, several pilot projects and trial runs have been started in various countries. In Malaysia, TNB has announced nationwide smart-meter rollouts to commence in 2016, and 300,000 meters to be installed during the year. Around 8,000,000 meters are likely to be installed by 2022. MERALCO in The Philippines is undertaking a pilot project involving installation of 40,000 smart meters, and plans to complete installation of 100,000 prepaid meters by 2016. In Thailand, Provincial Electricity Authority is ready to launch the installation of 120,000 residential smart meters in 2018.

Conclusion

The AMI market is going through growth phase in Asia. As part of power grid digitization, electrical utilities in China, Japan, and South Korea are keen on installing AMI. Till 2020, these countries will drive the market plan. Malaysia, Thailand, and the Philippines have smart meter/prepaid meter installations planned in the next 2-3 years. AMI rollouts will create massive opportunities for service and solutions companies. Data security and uncertainty in communication standards are key elements in this sector. Meter companies, network companies, meter data management (MDM) system vendors, and key market participants are working in partnerships or with associations to address this interoperability challenges.