Current vehicle development platforms are skewed towards electrification. However, the challenge for automakers is that it is not just electrification but autonomy as well that will determine their future. It is critical, therefore, that they strategize best-in-class flexible and variable EV/AD platforms that can seamlessly transition into mobility intelligence platforms.

What such next-generation skateboard or rolling chassis platforms will do is essentially combine hardware, software and data analysis capabilities to enable fail-operational, scalable, and modular EV/AD production. In the process, the concept of physical platforms or physical ‘hats’ that have long defined conventional platform development approaches will be replaced by digital equivalents. This, in turn, will be the springboard for the creation of personally built vehicles (PBVs) and new service-based revenue streams.

At least, this is what should be happening. The problem, as we see it, is that it’s not.

The Need for Purpose-built Electric Platforms with Inherent Automation Capabilities

Burdened by well-established legacy systems, cost considerations and apprehensions related to the transition to entirely new platform architectures, most automakers have chosen simply to either modify or to reengineer their existing platforms into electric/electrified platforms. But as electrification and autonomy become more established, the long-term potential of such incremental, piecemeal approaches will stand exposed.

We see these limitations reflected in three crucial areas. Firstly, in terms of the inability to scale the platforms to allow them to work with other applications or new functionalities like automation and connectivity technologies. Secondly, in terms of the inability to realize cost and resource efficiencies. And, thirdly, in terms of the inability to deploy new business models.

That’s why we strongly believe that automakers should be pushing forward on purpose-built platforms for EV production in ways that enable automation to be seamlessly introduced. In other words, rather than merely modifying their existing platforms, OEMs should be aggressively building dedicated electric platforms that possess the inherent capability to be automated as well. We are confident that this strategy will allow the three restrictive factors associated with incrementally adapted platforms to be easily overcome.

The Criticality of Fail-Operational, Modularity and Scalability Functionalities

A platform’s success in enabling electrification and automation will pivot on it having three fundamental capabilities: fail-operational, modularity and scalability.

Fail operational or redundancy functionalities will need to be a core in-built attribute of future EV / AD platforms. This mirrors increasingly sophisticated vehicle automation where multiple technologies need to be in play to ensure that even if one system fails, alternate paths are available to bring that functionality back into the game, offset the absence of the human element, and reassert control. The ability to ensure such backup, fail-operational capabilities that ensure vehicle / driving safety will be the bedrock of successful vehicle automation.

Accordingly, fail-operational or redundancy functionalities will need to be steadily integrated onto a single platform across steering, braking, suspension or, indeed, any other key chassis or safety-related application. The key idea here is that automakers should view fail-operational not just in terms of discrete systems/technologies but more holistically as intrinsic features of full-fledged EV/AD vehicle development platforms.

The central idea behind modularity is that it will afford automakers the chance to be flexible with the array of possible dashboard or electronic unit combinations used in a vehicle. Modular plug-and-play flexibility will allow them to achieve digital customization according to the particular use case of the vehicle. The main premise here is that modularity will enable a range of diverse functionalities to be introduced into the vehicle without the need to change the fundamental building blocks of the platform itself.

Automakers have so far proved very skillful in customizing solutions for specific vehicles and applications. However, the dawn of EV/AD vehicles with the attendant profusion of digital elements in the mix will cause them to struggle with scalability issues. Many simply lack the proficiency to build scalable platforms and will necessarily have to explore a range of collaborative business models in order to achieve scale.

How Digital ‘Hats’ Will Be Central to Successful EV/AD Platformization

The red thread running all these themes is the idea of digital ‘hats’. Physical platforms with a physical design and a physical interface have long been a staple of the traditional automotive industry. But the industry is now set for massive disruption as physical ‘hats’ give way to digital ‘hats’ in consonance with the development of electric and autonomous capabilities.

Indeed, EV/AD platform development will have to account for multiple software complexities like electric /electronic architecture, sensor integration, and communication protocols. As this happens, continuing with a primarily physical or hardware approach will prove self-defeating.

Instead, automakers need to embrace a paradigmatic change in thinking: hardware is no longer the whole but only a part of the whole and, that the physical manifestation of the platform will necessarily have to be replaced by its digital manifestation. In this context, it will be modular, flexible, scalable and digital EV/AD platforms that alone will have the ability to support multiple digital ‘hats’ on top. Only when this happens will the resultant ‘mobility platform’ be able to birth the emergence of PBVs and unleash the full potential of service-based revenues.

Co-Creation Models in the Spotlight

Easier said than done. While the automotive industry has excelled at plug-and-play manufacturing and being able to design vehicle- and application-specific solutions, it still has a long way to go in building competencies in the context of the new digital architecture requirements of EV/AD vehicles.

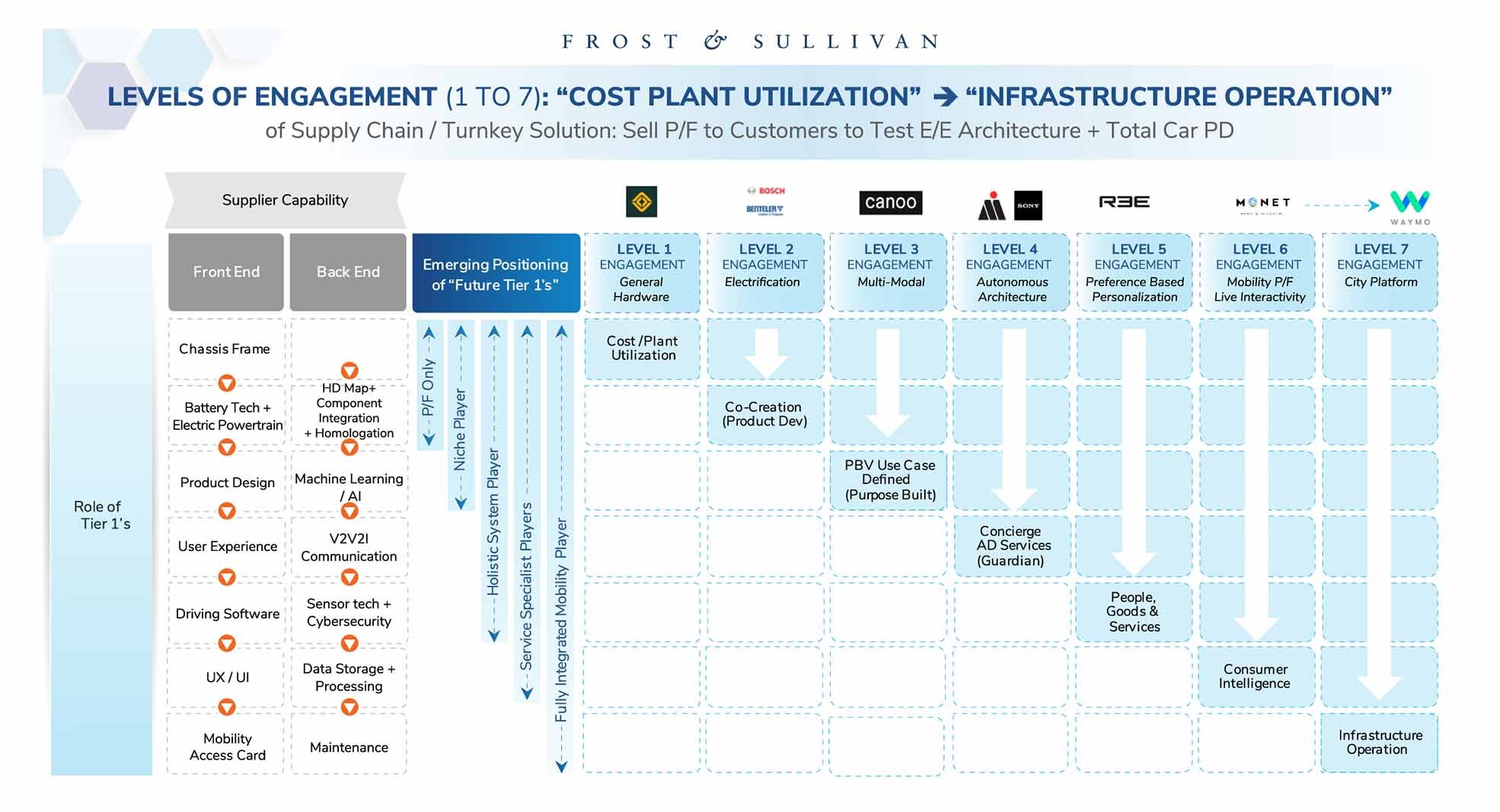

In their race to the finish line, automakers, start-ups and Tier Is are employing a range of different business models. Consequently, we are seeing the emergence of at least three to four distinct business models. The first and most promising, in our opinion, is co-creation. Here, a partnership/collaborative approach, underpinned by innovation and investor interest, will help fast-track platform development initiatives. Other approaches include in-house development to ensure complete ownership of the platform and licensing models that focus on selling the technology.

The Final Word

Our recommendation to the automotive industry as it heads towards EV/AD transformation is, therefore, unequivocal. Deploy a skateboard or rolling chassis approach that leverages purpose-built EV platforms with in-built autonomous capabilities. Equip the platform to be fail-operational, modular, and scalable. Recognize that hardware is only part of the whole mobility idea. Embrace the powerful concept of digital hats. Collaborate and co-create to get ahead in the competitive sweepstakes.

The essential idea is to think big, bold, and different to ease seamlessly into the EV/AD age.