Chinese ride-hailing behemoth, Didi Global, recently announced that it was partnering with Chinese new energy vehicle manufacturers to develop robotaxis that it planned to deploy in its fleets by 2025. This is just one of the many instances where shared mobility – robotaxis in this case – has been in the spotlight.

The move away from personal transport, paralleled by the intensifying thrust on integrated, multimodal, and sustainable transport networks, is providing a fillip to the shared mobility market. Such seismic shifts are being underpinned by evolving customer expectations and a raft of enabling technologies. Accordingly, total GMV from the shared mobility market is set to exceed $1 trillion in 2023, catalyzed by the ride-hailing segment.

Rising maturity in terms of shared mobility services means that operators can now move closer to achieving consistent profitability. The fulcrum of this shift will be technology, with start-ups and technology companies at the forefront of this transition.

Transformation in the shared mobility market will be led by accelerated electric vehicle (EV) penetration in car sharing and ride-hailing fleets and reinforced by deepening partnerships between OEMs and shared mobility operators. Simultaneously, dynamic changes in mobility patterns and demands will emphasize the need for traditional public transport operators to synergize with new mobility service providers.

To learn more, please see: Global Shared Mobility Outlook, 2023 or contact [email protected] for information on a private briefing.

Convergence of Sustainability Agendas, Push from Cities, and New Technologies to Drive Market Development

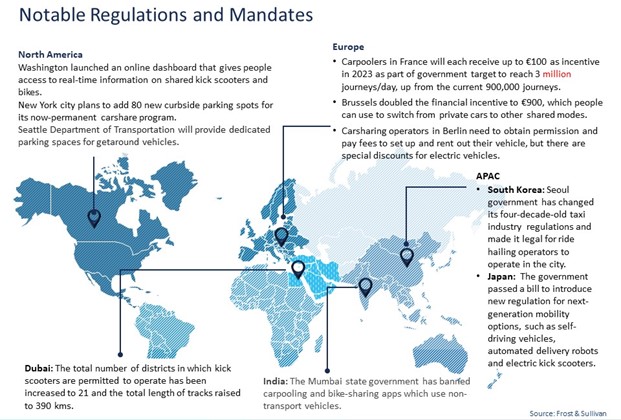

From car-free cities, integrated multimodal transport systems and favorable car sharing policies to preferential parking fees, supporting infrastructure development and EV integration in shared fleets, cities are playing a key role in proactively driving shared mobility usage. The switch to electrified or alternative fuels in shared mobility fleets will represent a high impact trend in 2023 that will align with sustainability agendas being championed by cities.

Autonomous shared mobility is disrupting the traditional automotive ecosystem, compelling component manufacturers and automotive companies to strategically recalibrate and strengthen their technological capabilities. Based on its varied applications and stage of development, Frost & Sullivan expects the market for autonomous shuttles to develop faster than that of robo-taxis.

The autonomous shuttles segment will develop rapidly, penetrate new verticals, and deploy a range of third-party solutions. Lessons from the pilot testing phase will be leveraged to design economical, next-generation shuttles capable of Level 4 autonomy in real-world settings.

From a competitive standpoint, there will be increasing consolidation in fragmented segments like micro mobility sharing as participants strive to achieve economies of scale. Consolidation will also result from a shrinking pool of participants: a flurry of exits is anticipated as companies leave the market to focus on more profitable areas.

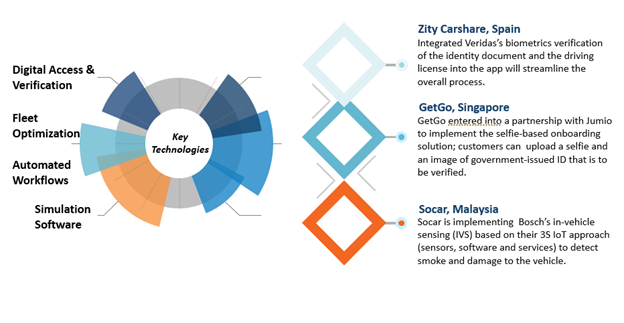

Connectivity, machine learning and artificial intelligence-based technologies will emerge as powerful tools to help operators realize seamless and effective fleet data management, workflow automation, and enhanced security.

Such technologies will also be crucial to addressing the looming threat of bans on kick scooters over safety concerns. With cities mandating safety standards for kick scooters, technology-enabled changes will be implemented in the manufacturing stage even as supporting infrastructure is built to ensure more permanent changes in driving behavior.

Demand Responsive Transit (DRT) has become the fulcrum of public transport, with over 100 B2G DRT projects being launched globally in 2022. The rising implementation of DRT in rural areas mirrors the need to meet transport needs in underserved rural areas. The momentum of DRT is set to carry over in 2023 as well.

Strategic Partnerships and Business Model Diversification will be Crucial

As a new ecosystem develops, strategic partnerships and service diversification will be crucial. Stakeholder collaboration—between automotive and technology industry participants, city authorities and government policy makers, and shared mobility service providers with OEMs and public transport administrators will incubate new business models.

Participants in the shared mobility space should strengthen their core technological competencies to capture emerging growth opportunities. Identifying technology partners with complementary expertise will enable shared mobility operators to boost fleet efficiencies and profitability. Meanwhile, data sharing between public transport and private mobility operators could create integrated solutions that spur the uptake of mobility as a service (MaaS).

Amidst technology disruption, automotive and technology industries should deepen their partnership and design new business models that maximize on the opportunities offered by shared mobility. Simultaneously, fleet operators should work towards making transportation smarter, safer, and more sustainable.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility