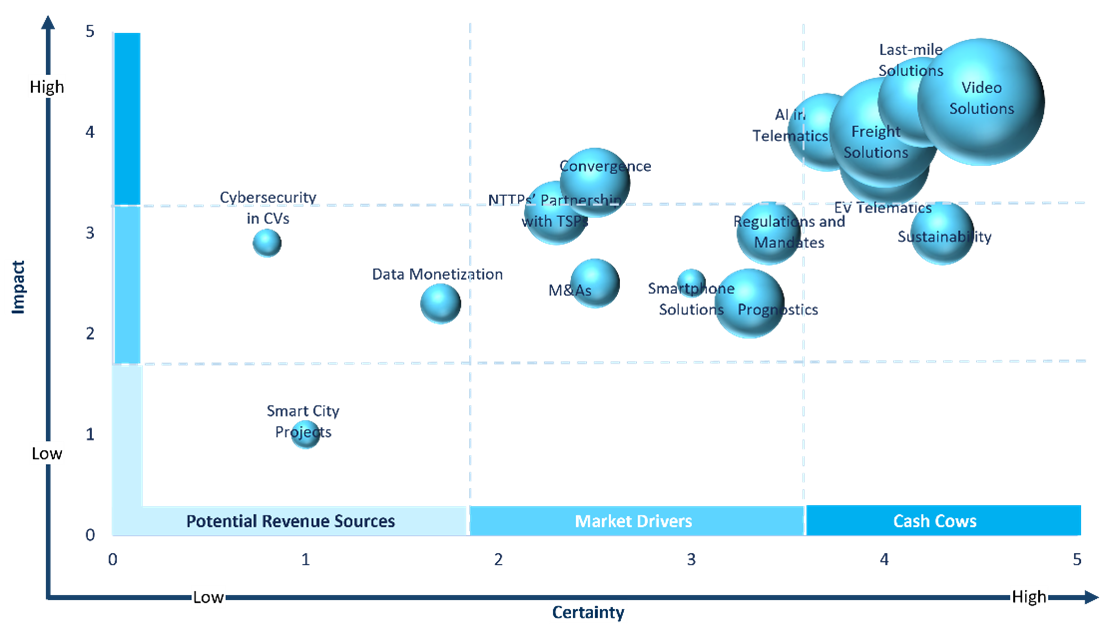

Technology-driven disruption is set to continue transforming the connected truck telematics market in every region. Among key trends that will shape the market in 2023 include the mainstreaming of video solutions, the growing prominence of digital freight mobility platforms, and the expanding incorporation of AI and machine learning (ML) across most telematics systems.

Daimler’s recent announcement regarding OEM integration of Lytx video hardware as factory fit; explorations into several application areas for AI being researched upon and investigated by TSPs like Samsara, Motive and AI enablers like Ambrella AI and Visionary AI suggest the significance of such tech-driven innovations in future market growth.

Meanwhile, corporate and product roadmaps will exhibit a deepening commitment to sustainability. In keeping with the pivot to clean mobility, fleet electrification in the light vehicle (LV) segment will pick up pace. This, in turn, will boost the uptake of electric vehicle (EV) fleet management solutions. Simultaneously, the boom in last-mile logistics will support the expanded use of light commercial vehicles (LCVs) and city distribution vehicles by transportation service providers (TSPs).

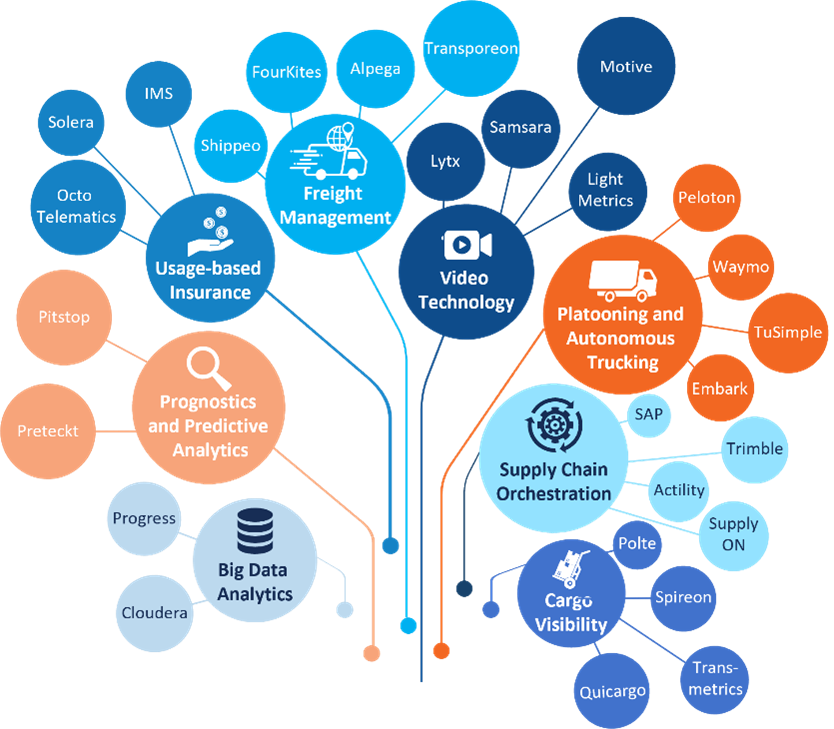

Figure 1: AI applications in video technology among other application areas

Technology Disruption is Widespread

Across Latin America and Europe, video solutions will emerge as a powerful tool to improve road, asset, and operational safety. They will have an increasingly central role to play in realizing resource efficiencies, while confronting challenges related to rising fuel prices and supply chain disruptions. The rising appeal of video solutions will have a positive impact on the adoption of fleet management systems.

Offering real-time operational intelligence across the value chain, digital freight mobility platforms will enable superior transparency, flexibility, and operational efficiencies. Automated data collection and analysis across the freight transportation ecosystem will help shippers, carriers, and other service providers to actively support customers with supply chain risk mitigation capabilities. Accordingly, Frost & Sullivan anticipates innovation driven growth and higher investments in the digital freight and logistics market in 2023, paralleled by a flurry of partnerships between TSPs and digital freight brokerage companies.

As in other industries, the use of AI and ML in the telematics industry will expand. These advanced technologies will be effectively deployed in fleet management systems (FMS) and transport management systems (TMS) as well as autonomous, freight, and insurance applications where they will be leveraged to identify driver risks, improve fleet safety and performance, and provide accurate data-based business insights. Two differing approaches have marked TSP, OEM, and Tier 1 strategies as they scramble to stay ahead in this fast-changing space: some have turned in-house to build up their AI expertise, while others have chosen to partner with AI companies.

To learn more, please see: Global Connected Truck Telematics Outlook, 2023 or contact [email protected] for information on a private briefing.

Focus on Sustainability, EV Fleet Management and Efficient Last Mile Logistics

Against intensifying climate change concerns, sustainability will become central to strategic roadmaps. Fleets, particularly in Europe and North America, will embrace clean mobility and carbon-neutrality. This trend is already evident such as in the case of Bridgestone’s E8 sustainable mobility vision or the Michelin Group’s agenda of achieving between 20% and 30% of its revenues from non-tire related activities by 2030.

Sustainability imperatives have encouraged the shift to electrified fleets. This, in turn, will place the spotlight on EV fleet management. Drawing on charging and battery intelligence, EV fleet management will support better fleet scheduling and grid management as well as enhanced overall operations and maintenance of EV fleets and related supply equipment.

The boom in last-mile deliveries, while presenting growth opportunities, is also rife with challenges. The use of multiple solutions working coherently as parts of a seamless whole will support greater efficiency in last mile delivery. The continuous development of capabilities and their seamless integration into more holistic solutions will be crucial to succeeding in the last mile market.

Figure 2: Key Trends Driving the Global Connected Truck Telematics Market

Conclusion

Video telematics is gaining wider traction as part of a more comprehensive fleet management ecosystem. Technology advancements integrating AI and ML with video safety solutions are burgeoning. To maximize uptake, companies will need to develop cost-effective AI and ML dashcams and video analytics systems. Promisingly, low-cost hardware and economies of scale are lowering the cost of ownership, while motivating adoption of AI-enabled video systems by fleets. In addition, highlighting the multiple advantages of video telematics – its role in boosting driver safety, supporting real-time coaching – will emphasize its appeal as a driver-friendly solution.

With a potential market value of $100 million, growth in the nascent EV telematics market is set to accelerate, spurred by light eLCVs in North America and Europe. To successfully integrate EV fleet solutions and provide value to fleet operators, TSPs will need to evaluate multiple strategies. Among them, partnering with battery analytics firms and charge station infrastructure providers to access real-time information on battery usage and charging patterns and undertaking remedial steps to improve battery life. EV OEMs will be crucial data partners for TSPs and will increasingly collaborate with OEMs to collect relevant battery and vehicle systems data.

Transparency and real-time freight visibility, together with control over supply chain operations, will support enhanced resilience. Predictive and actionable insights will assist stakeholders in realizing a tech-enabled digital supply chain environment that will support continuous improvements and provide customers with a solid freight transportation experience.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility