Qualcomm’s Snapdragon Digital Chassis has recently made significant inroads into the automotive industry, most prominently in the Renault Megane E-tech and Austral. It comes as little surprise, therefore, that Renault has chosen Qualcomm to co-develop software-defined vehicles (SDVs) due to their resounding success with these two vehicles. The Renault-Qualcomm partnership also signifies a fundamental shift in the automotive value chain which is heading increasingly towards a partnership-driven ecosystem to meet respective company needs.

Renault envisions the new architecture to enable software-over-the-air (SOTA) updates as well as centralize multiple functionalities, including a digital cockpit, advanced driver assistance systems (ADAS), telematics, and cybersecurity in its next-generation SDVs. Moreover, the open architecture design means that it will be accessible to other vehicle manufacturers.

This partnership reflects the growing recognition among automakers about the significant advantages that SDVs deliver over traditional, hardware-centric approaches. For a start, SDVs open up the prospect of enhanced safety and features-on-demand (FoD) comfort and convenience services. They offer the ability to constantly improve and upgrade vehicles over their lifecycle via over-the-air (OTA) updates, enhance infotainment features, and support key functional capabilities related to powertrain and vehicle dynamics. In essence, this means automakers can build new business models based on continuous revenue generation from new features, functions, and services. In turn, this facilitates the forging of deeper, more meaningful customer engagement.

To learn more about trends impacting SDVs and growth and deployment strategies of different OEMs and suppliers in the market, please access our report, Strategic Insights and Growth Opportunities for Software-defined Vehicles or contact [email protected] for information on a private briefing.

Our Perspective

As the automotive industry moves towards a software-defined future, strategy will become even more crucial to stay ahead of the competition and adapt to any unforeseen events. The term ‘SDV’ is one of the industry’s current buzzwords, but it will mean different things to different OEMs, each of whom will need to develop their own way of thinking, strategies, and goals.

Opportunities and new value chain in SDV

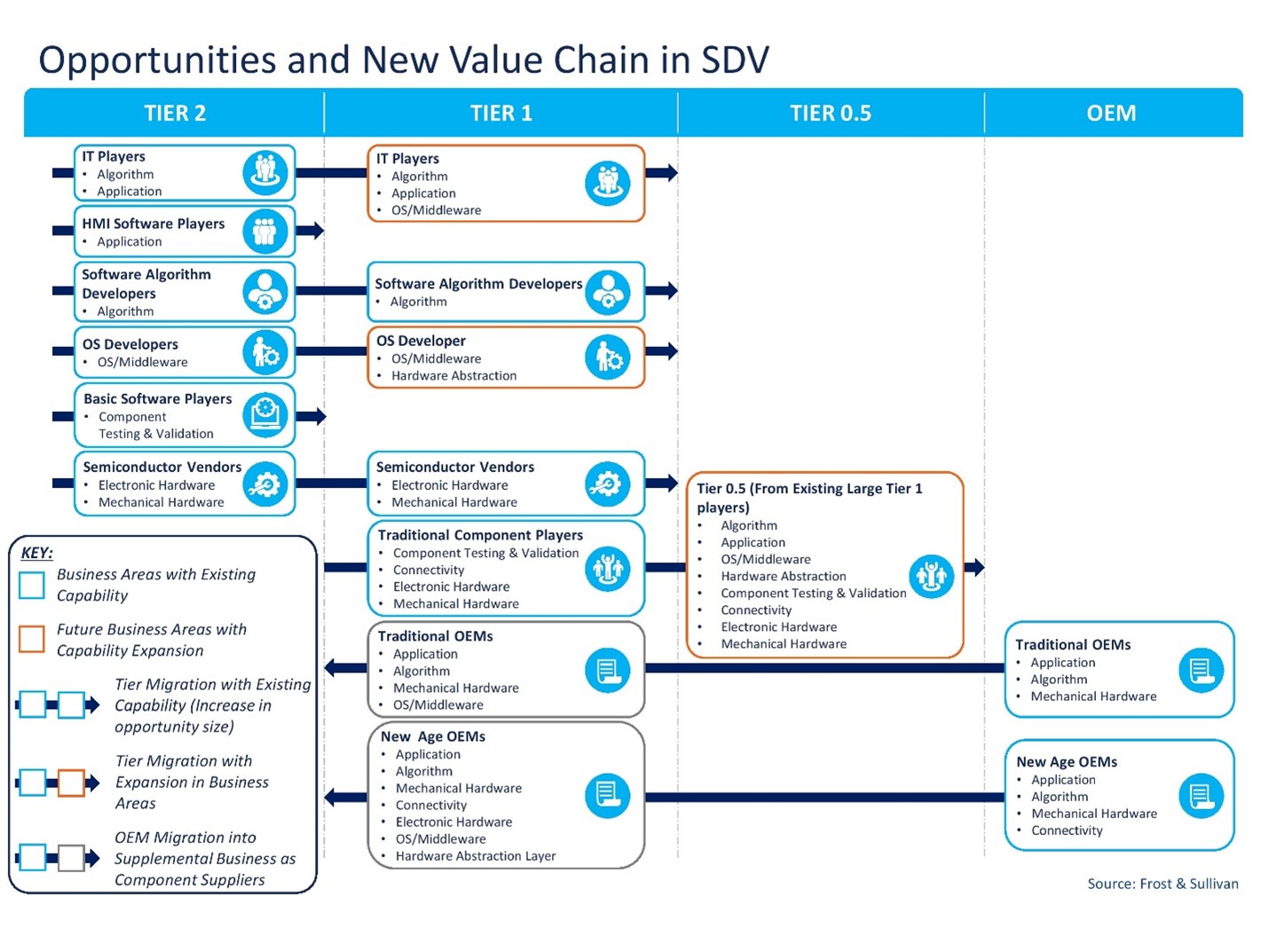

Critically, SDVs will usher in tectonic shifts across the automotive value chain. Firstly, we foresee generalist suppliers losing ground as a consequence of realignment across the value chain. Secondly, we will see OEMs selecting co-creation partners from new Tier 0.5 suppliers with end-to-end capability, including white-labeling solutions. Indeed, because they are specialists, some suppliers will be able to provide unique value. And, thirdly, we will observe the emergence of a cooperative and innovative environment in consonance with SDVs, where automakers and Tier I and Tier II suppliers will work alongside tech giants and their competitors in a co-operative value chain.

Today, partnerships between automotive OEMs and tech companies are birthing new SDV ecosystems. Simultaneously, consumer focus on enhanced vehicle safety features is underpinning the demand for improved vehicle connectivity, while catalyzing innovation in areas such as usage-based insurance, vehicle data, telematics, and cybersecurity. In a bid to retain their relevance as the industry transitions to SDVs, established OEMs will look to collaborate with start-ups to leverage their technological expertise. We will also see the shift to cloud-based architectures accompanied by more volume OEMs offering FoD solutions, with FoD emerging as a key revenue generator for OEMs between 2022 and 2025.

One of the major challenges we foresee in the transition to SDVs is the need for auto manufacturers to shift towards a platform development structure from a function-oriented one. However, in many cases, progress has been hobbled by a skills shortage. This highlights the need for OEMs to rethink recruitment and talent management approaches for a digitally driven era.

What is becoming increasingly clear is that the hardware model is headed towards obsolescence and the software model is the future and is, indeed, pivotal to revenue generation. This has made it incumbent on automakers, suppliers, and technology providers to co-develop SDV architecture. Recent partnerships in the SDV ecosystem, much like in the case of Qualcomm and the Renault Group, indicate that automakers are recognizing industry convergence and the need to partner with stakeholders that have traditionally not been part of the automotive industry.

At the same time, this unprecedented shift from hardware to software demands that automakers relook at their infrastructure and investment, vehicle architecture, and organizational structures. Simultaneously, they will need to understand that achieving any significant revenue generation from new SDV models will take at least another decade.

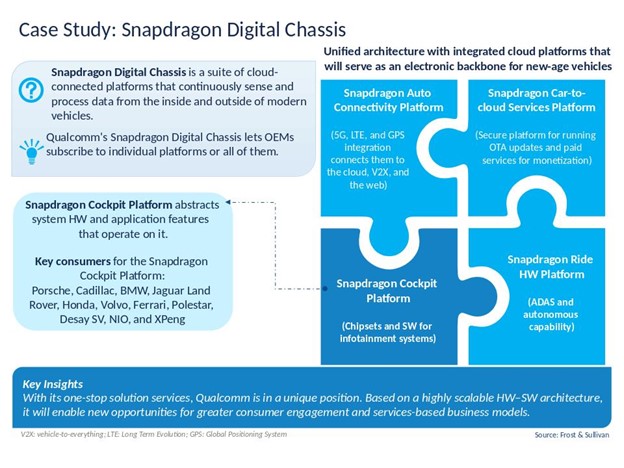

Case Study: Snapdragon Digital Chassis

Our forthcoming report on the developing SDV ecosystem covers several case studies in cybersecurity, hardware modules, middleware, vehicle OS domains. Based on its one-stop solution services and highly scalable hardware-software architecture, we believe Qualcomm will enable automakers to unlock new opportunities for deeper consumer engagement and more lucrative services-based business. The Snapdragon Digital Chassis’s unified architecture with integrated cloud platforms will be an attractive proposition for next-generation vehicles, evinced by the long list of customers already using the Snapdragon Cockpit Platform, including Porsche, BMW, Honda, Volvo, NIO, and XPeng, among others.

Schedule your Growth Pipeline Dialog™ with the Frost & Sullivan team to form a strategy and act upon growth opportunities: https://frost.ly/60o.