It is all about digital lifestyle extension, and automakers are focused on enriching consumers’ in-vehicle experience with the help of advanced technologies like artificial intelligence, augmented reality, and self-learning. These technologies are transforming the vehicle, making it a seamless part of customers’ connected, digitally driven ecosystem. From information to entertainment, services to safety, comfort to convenience, the quest is to create an in-vehicle experience that is simultaneously engaging, productive, immersive, and relaxed for vehicle occupants.

Keeping with this theme of continuously enhancing the onboard customer experience comes the announcement of Renault’s partnership with four application developers: EasyPark, RadioPlayer, Sybel, and Vivaldi browser. The partnerships will support the rollout of four apps that are slated to be offered through the OpenR Link – a connected infotainment interface with personalization capabilities. Among the vehicles likely to have these apps include the All-New Megane E-Tech Electric and the forthcoming New Austral. The apps will support easy parking solutions (EasyPark), a wide range of audio programs (RadioPlayer and Sybel), and convenient browsing (Vivaldi).

Meanwhile, Audi’s recent partnership with 4.screen will allow customers to access wide-ranging, contextual real-time information on points of interest (PoI). 4.screen’s location-based services will be integrated into the vehicle’s Multi Media Interface (MMI) using new cloud technology. This means customers will not only be able to choose from various PoI and navigate them, but they will also be able to view the real-time availability of other products, services, and exclusive offers in that location.

For more information on how automakers are reimagining the onboard customer experience in automated vehicles, please access our research report – Global Life on Board in Automated Vehicles Growth Opportunity, or contact Sathyanarayana Kabirdas at [email protected] for information on a private briefing.

Our Perspective

The rise of connected and autonomous vehicle technologies has spawned the term ‘life-on-board’, which refers to the time occupants will spend on board a connected and automated vehicle in the future. What we will see with Level 4 automated driving is an all-round transformation in how vehicles are designed. Since Level 4 implies the need for minimum-to-no driving activity, we will see vehicle control systems related to steering, braking, and acceleration being concealed, with a central automated system navigating the vehicle, thereby leaving the occupants of the vehicle to do whatever interests them.

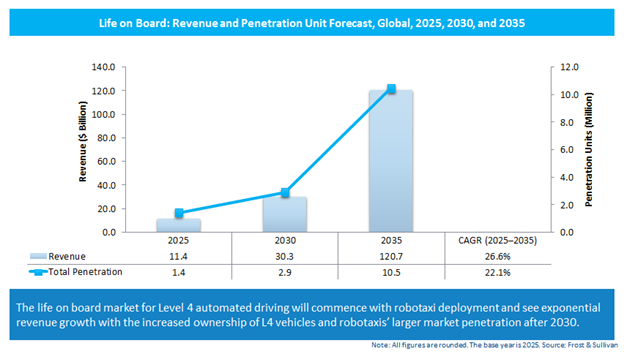

Currently, ‘life-on-board’ is an abstract concept that embraces the idea of advanced cabin and cockpit technologies that enhance engagement, comfort, and convenience features. These ideas are rooted in the certainty that Level 4 automated driving features will impel not just dramatic changes in vehicle cabin/cockpit design but also the role of vehicle occupants. This will drive automakers to offer engaging features that offer comfort, convenience, information, and entertainment, even when the occupants do not own the vehicle. In essence, we will see vehicle manufacturers focus on service-oriented models rather than traditional vehicle sales. Our research indicates that the total addressable market linked to life-on-board services could be around $120.7 billion by 2035.

Indeed, the evolution of a connected ecosystem, advancements in automotive electronics, and software are already driving the increased adoption of smart features within vehicles. In terms of cabin technologies, health, wellness, and wellbeing will be an important trend to capture passenger data and offer customizable services. However, to fully leverage growth potential, there will have to be a concerted effort to assuage concerns over data protection and privacy. Growth in cockpit technologies will be from immersive driving experiences; enriched user interactions; buttonless, multimodal, and graphic-intensive displays; fully conversational digital assistants; and AR/mixed reality heads-up displays (HUDs).

Renault and Audi’s new partnerships essentially reflect two trends. One is the flattening of the conventional pyramidal value chain wherein C.A.S.E. mobility and increased software usage have compelled the automotive industry to accommodate multiple technology participants in the value chain. OEMs and suppliers are working with emerging technology companies to develop, validate, produce, and integrate new features for future automated vehicles. The second is the trend to reimagine the vehicle as being a connected mobile device that seamlessly fits into customers’ highly interconnected, digitally driven ecosystem.

At the core of the life-on-board universe will be the customer; technology-driven strategies will seek to progressively enhance the customer experience while simultaneously releasing a continuous stream of new service-related growth opportunities.

Schedule your Growth Pipeline Dialog™ with the Frost & Sullivan team to form a strategy and act upon growth opportunities: https://frost.ly/60o.